The role of supply-side policies

Definition:

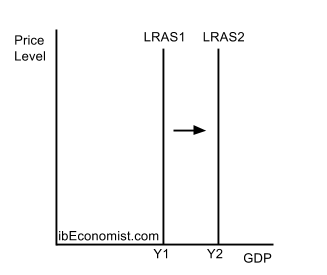

- Supply-side policies – are government policies aimed at increasing productivity and shifting the LRAS curve to the right (increase the economy’s productive potential).

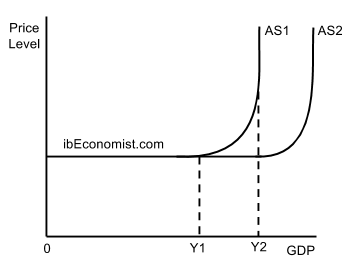

The aims of the supply-side policies are to positively affect the production side of the economy by improving the institutional framework and the capacity (quality and quantity of factors of production) to produce. Thus, supply-side policies shift the Long Run Aggregate Supply curve (or the vertical part of the supply curve in the Keynesian model) to the right.

There are two types of supply-side policies:

- Market based

- Interventionist

Interventionist supply-side policies

1. Investment in human capital

Governments might invest in education and training of people. Improve the level of schools or make education free. Also, provide various training schemes. In the short run, such policies increase aggregate demand, but importantly – shift the LRAS curve to the right. This happens because people’s skills improve. Hence, productivity increases.

2. Investment in new technology

Governments could invest in research and development of new technologies. Again, that would increase aggregate demand in the short run, however, in the long run LRAS would increase. That happens because new technology can increase productivity: e.g. 3D printers made modelling or even production of various products quicker than ever.

3. Investment in infrastructure

Government expenditure might go towards infrastructure. Simple example – improving logistics could decrease transfer times and costs in turn increasing productivity and shifting the LRAS to the right. Remember the short term effect on AD!

4. Industrial policies

Governments might target specific economic areas through tax cuts, tax allowances and subsidised borrowing which would promote growth of those areas. E.g. Useful startups which could improve the efficiency of other areas of the economy.

Market-based supply-side policies

1. Policies to encourage competition

- Deregulation

- Privatisation

- Trade liberalisation

- Anti-monopoly regulation

2. Labour market reforms

- Reducing the power of labour unions

- Reducing unemployment benefits

- Removing minimum wages

All these reforms aim at making the labour market more flexible. E.g. When it is easier and/or cheaper for firms to hire and fire workers, they will be more likely to hire.

3. Incentive-related policies

- Cutting the income tax – the idea is that your leisure becomes more expensive after the tax cut and so you start working more. Refer to the Laffer curve and Substitution vs Income effects.

- Cutting the business (corporate) tax – firms get to keep more of their profit, that is an incentive to (take the risk) invest, find more efficient ways of production.

Evaluation of supply-side policies

All supply-side policies mentioned above can be evaluated in terms of:

- Time lags – some supply-side policies can take years to take effect (e.g. investing in human capital), others – much shorter.

- Ability to create employment – think whether a certain policy creates employment. E.g. investing in new technology can actually lead to technology substituting workers.

- Reducing inflationary pressure – can a certain policy help deal with high inflation? Try not to make a rather unrealistic argument that “governments could invest in better education and that would lead to higher productivity and eventually lower prices“. To see the effects of that investment on inflation can take up to 15 years, so does it really deal with inflation? Maybe in the very-very-long-run it does…

- Impact on economic growth – how certain policies can affect growth, which affect growth more than others and why.

- Impact on the government budget – some policies may be very costly (investing in infrastructure). However, privatisation might lead to short-term budget improvements (but remember that possible long term benefits were given up!).

- Effect on equity – how will a certain policy affect the distribution of income? Think about removing or changing the minimum wages, unemployment benefits.

- Effect on the environment – could deregulation lead to higher pollution or overall quicker degradation of the natural environment? Think about policies which could lead to increasing negative externalities.