Due to unequal distribution of factors of production it is hardly possible for the market system to result in equitable distribution of income. Even though inequality does provide incentives for businesses to research and improve, the popular opinion is that income/wealth should be redistributed from the rich to the poor. There are different ways this can be done each having its pros and cons. That is the main discussion topic between policy makers – ways and the amount of redistribution.

Indicators of income equality/inequality

Definitions:

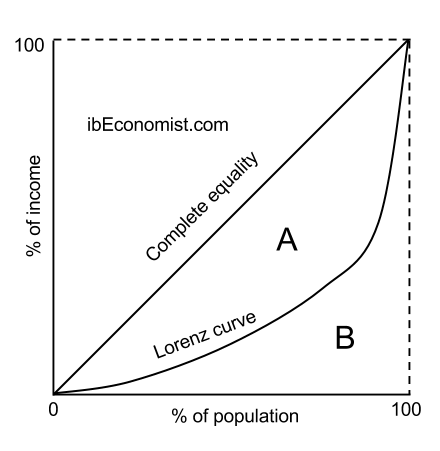

- Lorenz curve – shows proportion of a population’s income that is earned by a given percentage of the population.

- Gini coefficient – numerical measure of income inequality.

Lorenz curve above – the more the curve is bent the more unequal distribution of income. The 45 degree curve shows complete equality – 1% of population receives 1% of population’s income; 10% receives 10% and so on.

Gini coefficient’s formula: A / (A+B)

Gini coefficient values are between 0 and 1 (as can be seen from the formula above). The lower the value of the coeffcieint the lower the inequality. The higher the value of Gini’s coefficient the higher the inequality.

Promoting equity

The most popular way of redistributing income is taxation (and transfer payments). There are 2 types of taxes:

- Direct taxes are those placed on people’s incomes and wealth

- Indirect taxes are those placed on producers (goods/services) who then attempt to pass it onto consumers in the form of a higher price (e.g. VAT)

Taxes are:

- Progressive – the average rate of tax rises as the person’s income rises (e.g. most income taxes, because of tax-brackets)

- Regressive – the average rate of tax decreases as the person’s income rises (e.g. tax on fuel)

- Proportionate – the average rate of tax is constant

Taxes are the first step in the redistribution of income. The second step is for governments to pass on the collected taxes to the poor. That is done using transfer payments which are transfers of incomes from one person to another with no production taking place. Examples of transfer payments include unemployment benefits, old age pensions, child allowances, etc.

Governments can also use the collected taxes to provide socially desirable goods such as free healthcare or free education, infrastructure including sanitation and clean water. That makes those goods/services accessible to low income people which is also promotion of equity.

Poverty

Absolute poverty – when a household’s income is below the poverty line (official World Bank’s poverty line – 1.25$ a day).

Relative poverty – standard defined by the average income (required for a lifestyle in a typical society) in a certain country.

Causes of poverty:

- Low incomes

- Lack of human capital

- Unemployment

Consequences of poverty:

- Low living standards (leading to higher levels of diseases, child mortality rates, etc.)

- Lack of access to healthcare

- Lack of access to education

- Poverty-related social problems

Higher level students:

You have to know how to calculate the marginal rate of tax and the average rate of tax from a given set of data.