Another macroeconomic objective is low and stable rate of inflation.

Definitions:

- Inflation is persistent increase in the price level of an economy over a period of time.

- Disinflation is fall in the rate of inflation.

- Deflation – decrease in the price level of an economy over a period of time.

- Core or underlying rate of inflation – this measurement eliminates the effect of volatile swings in the prices of e.g. food or oil.

Inflation is mostly measured using the CPI – Consumer Price Index. It measures the changes in prices of a basket of goods and services consumed by an average household.

Weaknesses of the CPI:

- There is no such thing as an “average” household – different consumption patterns lead to different CPIs

- Quality of goods/services provided is not taken into account

PPI or the Producer Price Index measures the changes in prices of factors of production (capital, raw materials, etc.) and can be useful in predicting future inflation.

Consequences of inflation:

- Greater uncertainty that could lead to falling investment and consumption

- Redistributive effect – high inflation rate for savers means that the real interest rate they are getting on their money placed in a bank is smaller; high inflation rate for borrowers means the real interest rate they are paying because of their loan is smaller

- Export competitiveness falls (provided other exporting countries do not experience same or higher rate of inflation)

- Loss of purchasing power

- Shoe-leather costs (cost of searching for the best price)

- Menu costs (cost of constantly changing your goods’/services’ prices)

Even though students tend to remember shoe-leather and menu costs very well as negative consequences of inflation, they should not be the main priority in any exam question. Leave these small points for the last minutes of your exam when you are trying to squeeze out a couple of extra points.

Consequences of deflation:

- High levels of cyclical unemployment and bankruptcies – when people see falling prices, they believe they will keep falling and therefore, deter their spending. As a result, consumption falls and aggregate demand decreases, increasing demand deficient unemployment and eventually causing firms to go out of business.

There are two types of inflation: cost-push and demand-pull.

Causes of demand-pull inflation:

- Lower tax rates

- Growing government spending

- Lower interest rates

- Growing consumer confidence

- Economic growth in other countries (leading to growing exports, hence increasing AD)

- Depreciation of a country’s currency (leading to growing exports, hence increasing AD)

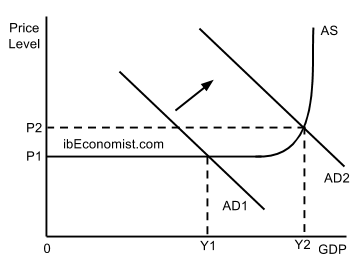

The diagram above illustrates demand-pull inflation. You have to know the explanation of why the price level starts rising as economy approaches the level of income of full employment. It could be because of for example there being not enough labour anymore. A firm wants to hire a worker however, is unable to because there aren’t any left. What does it do? Offers a higher wage than the one he is already getting at another firm. That increases the costs of production and so prices of goods and services (price level) rise P1 to P2.

Causes of cost-push inflation:

- Rising costs of production (capital, raw material and labour costs)

- Increased indirect taxation (e.g. VAT)

- Currency depreciation (leading to rising costs of production)

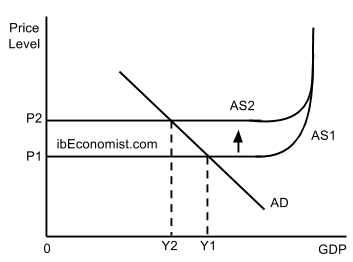

The causes mentioned above are illustrated in the diagram. Aggregate Supply falls meaning it shifts up and price level increases P1 to P2.

Curing inflation

To cure inflation, governments can use contractionary fiscal (cutting government expenditure and/or increasing direct taxes) and/or contractionary monetary policies (raising the interest rates) to decrease aggregate demand. Also, supply-side policies could be used. However, those mostly affect the economy in the (very) long-run. Therefore, there would be little-to-none instant effect on the price level.