Definitions:

- Monetary policy – it is the use of the interest rates (via manipulating the money supply) to influence aggregate demand.

- Interest rates – rates at which borrowers are charged or lenders paid for their loan. Typically expressed as an annual percentage.

Interest rate determination and the role of a central bank

The role of a central bank:

- Regulate the commercial banks

- Banker to the government – e.g. could issue bonds to finance government spending

- Usually responsible for interest rate determination (to achieve macroeconomic objectives)

- Responsible for exchange rates (holds foreign currency reserves)

Interest rate determination:

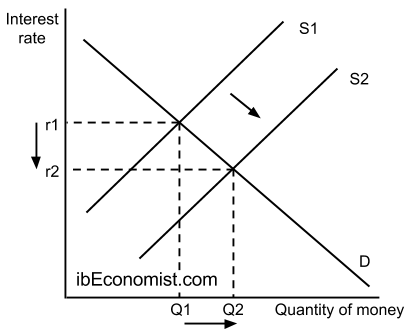

Interest rates are determined by the supply and demand for money. Central banks are able to manipulate the money supply and this way control the interest rate. In the given diagram, the central bank increased the money supply S1 -> S2. We see that the final outcome was falling interest rates r1 -> r2. If they had decreased the money supply, the interest rate would have gone up.

The role of monetary policy

Monetary policy and short-term demand management

Expansionary monetary policy – decreasing interest rates in an attempt to increase consumption and/or investment and thus, increase aggregate demand. Used to close deflationary (recessionary) gaps.

Contractionary monetary policy – increasing interest rates in an attempt to lower consumption and/or investment and thus, decrease aggregate demand. Used to close inflationary gaps.

Monetary policy and inflation targeting

Most countries have a target inflation rate and reaching that target might be the main macroeconomic objective (rather than full employment for example). Then the main monetary policy objective is reaching and maintaining that inflation rate. For example, in Eurozone, the target inflation rate is below but close to 2%.

Evaluation of monetary policy

Strengths of the monetary policy:

- Independence of the central bank means politicians are unable to influence its decisions (e.g. before elections they might like to decrease interest rates to inflate growth figures and take the credit)

- Interest rates can be adjusted incrementally

- Small time lag (especially in countries where the use of credit cards is high. The interest rate on your credit card falls/increases and that might change your consumption right away.) However, this point is highly debatable!

- Small time lags in the sense that central banks can change the interest rates quickly – without the approval of government officials (whereas changing taxes requires approval of the government). This point is also connected to the independence of the central banks.

Weaknesses of the monetary policy:

- Consumption/Investment might be interest inelastic (even though interest rates change by a large amount, consumption and/or investment does not respond by that much)

- Conflicting government objectives – falling growth might require expansionary monetary policy, however, high inflation could suggest contractionary monetary policy is needed.

- Limited effectiveness when the economy is in a recession – instead of borrowing, firms and consumers might simply repay the debts