Definitions:

- Exchange rate – value of a currency expressed in terms of another currency. (In other words: price of the currency in terms of another currency).

- Floating exchange rates (system) – when the exchange rate of a currency is determined by the supply and demand for that currency.

- Appreciation (of a currency) – occurs when a currency increases in value against another currency, i.e. it can buy more of another currency.

- Depreciation (of a currency) – occurs when a currency loses value against another currency, i.e. it can buy less of another currency.

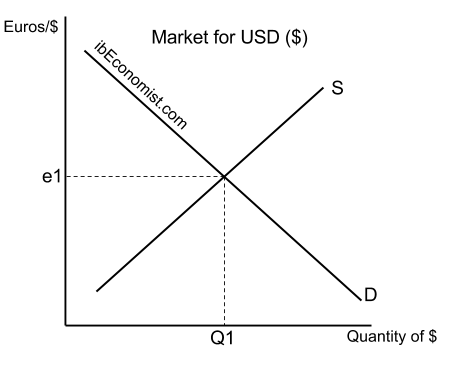

Determination of Freely Floating Exchange Rates

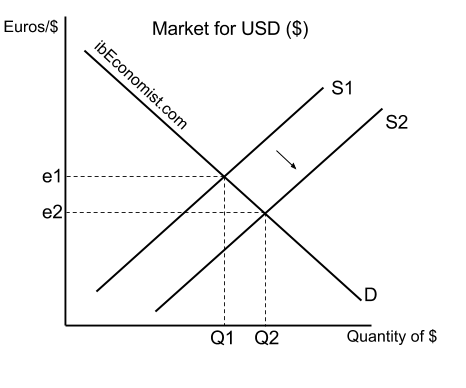

The diagram above for floating exchange rates shows that the value of the US Dollar ($) is at e1 where Supply (S) = Demand (D) for USD. At that exchange rate (e1), the equilibrium quantity of US Dollars is Q1. It is important to note that on the Y axis the value of $ is expressed in terms of how many Euros you can buy with $1 (There are variations of this diagram, hence, always consult your teacher about which one is the most appropriate). The higher the value of the US Dollar, the more Euros you will be able to purchase with 1 USD. The lower the value of the USD – the less Euros $1 will be able to buy.

For people doing the IB Higher Level Economics course, you need to know some maths connected to floating exchange rates:

Say, you are given that 1 GBP = 1.25 EUR. You have to know how to express the value of 1 EUR in terms of GBP. How? If 1 GBP = 1.25 EUR, then 1 EUR = 1/1.25 GBP –> 1 EUR = 0.80 GBP

Changes in Floating Exchange Rates

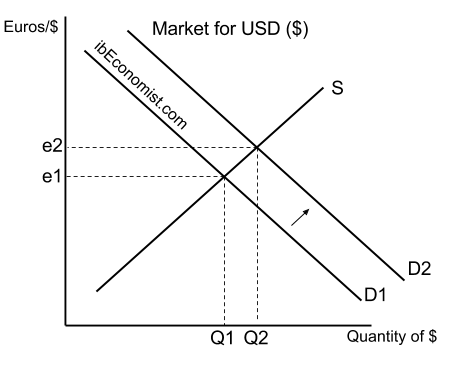

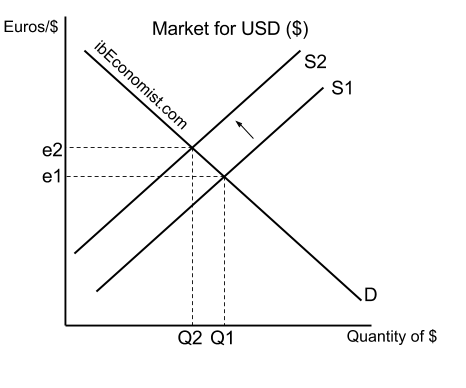

2 diagrams showing an appreciation in the floating exchange rates:

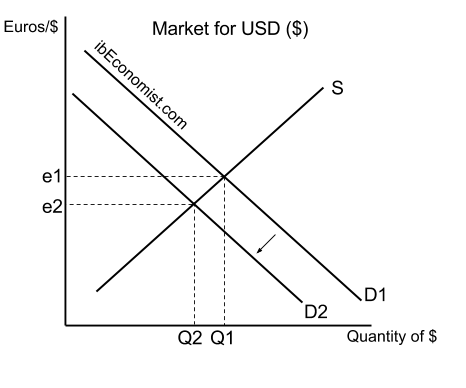

2 diagrams showing a depreciation in the floating exchanges rates:

For your IB Economics course you need to know the following factors affecting supply/ demand of currencies and hence, their floating exchanges rates:

- Foreign demand for a country’s export:

- Foreign demand for a country’s export increases. To buy larger quantities of that export foreigners must have more of that country’s currency. So, the demand for the exporting country’s currency increases and hence, its currency appreciates. (Diagram 1)

- If the demand for a country’s export decreases, the demand for that country’s currency will fall and therefore, the currency will depreciate. (Diagram 3)

- Domestic demand for foreign imports:

- Demand for a foreign import increases. To buy more of that import people need to get more of that country’s currency. To acquire that currency, they must sell their own currency. Supply of domestic currency increases and hence, it depreciates. (Diagram 4)

- If the demand for a foreign import decreases, the domestic currency will appreciate because less of the foreign currency will be needed and so the supply of the domestic currency will decrease. (Diagram 2)

- Relative interest rates:

- Interest rates in country A are higher than interest rates in country B -> people of country B want to keep their money in country’s A banks, hence they require more of country’s A currency. Demand for country’s A currency increases and it appreciates. (Diagram 1) Also, people living in country A might supply less currency to earn a higher interest in their domestic banks, hence the supply of the currency decreases and it appreciates. (Diagram 2)

- Interest rates in country A are lower than interest rates in country B -> people in country A want to keep their money in country’s B banks offering higher interest so they start purchasing more of their currency by selling more of their own. Supply of country A currency increases and it depreciates. (Diagram 4) Also, foreigners might decide to keep more of their money in country’s B banks and so demand less of country’s A currency. Demand falls and country’s A currency depreciates. (Diagram 3)

- Relative inflation rates – the inflation of the country does not directly affect the exchange rate. However, relative inflation rate (compared to other countries’ inflation) does.

- Say the inflation rate in the US is 5% and the inflation rate in Germany is 2%. Because goods and services are becoming more expensive in the US quicker than in Germany people might choose to buy goods/services from Germany. This action requires to have euros and to get euros you need to sell USD, hence, the supply of USD increases and the US Dollar depreciates. (Diagram 4) Or it could be the case that US exports are becoming less competitive when compared to Germany’s (because their price is increasing faster) so people might start demanding less of US exports and more of Germany’s. Therefore, demanding less US Dollars -> demand for USD decreases and the currency depreciates. (Diagram 3)

- If the inflation in the US is lower than in Germany the story reverses. People will demand more US exports, so the demand for the currency will grow (Diagram 1), leading to currency’s appreciation. Also, people might supply less of USD as they might be needing less euros because the imports became too expensive (Diagram 2), leading to appreciation of the US Dollar.

- Investment from overseas in a country’s firms (foreign direct investment and portfolio investment):

- For foreigners to invest in a country (FDI and portfolio investment) they must acquire that country’s currency. Hence, they will increase the demand for that currency and it will appreciate (Diagram 1). It is also possible that they will decrease supply, because some investors might already be holding USD which they were planning to sell but decide not to (Diagram 2).

- Important to note that this works both ways: foreign investors might decide to pull the money out (sell the factories or their shares) and then exchange that country’s currency for another one. Leading to increasing supply (and possibly falling demand) and currency’s depreciation (Diagrams 3 and 4).

- Speculation (“hot money” flows): same as relative interest rates as speculators usually chase higher interest rates.