Definition:

- Tariff – a tax on imports with an attempt to restrict imports, possibly raise revenue for the government (however, during an exam check the context the term is used in and tweak the definition to fit)

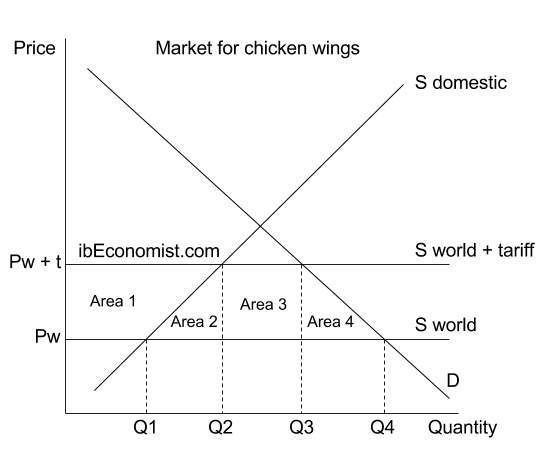

Consider the tariff diagram below:

The diagram above is a diagram for the UK importing chicken wings. When there is free trade, the equilibrium is where S world intersects D at quantity Q4 and Pw. Domestic suppliers supply Q1 and imports are Q4 – Q1. Then a tariff of size (Pw + t – Pw) is introduced. That raises the price of chicken wings in the UK to Pw + t. Quantity supplied by domestic producers increases Q1 -> Q2 (extension of S domestic). Quantity demanded contracts Q4 -> Q3. Hence, imports shrink to (Q3 – Q2).

Effect of the tariff on different stakeholders:

- Consumers: prices are higher than before, possible loss of higher living standards* and consumer surplus limited by area (Area 1 + Area 2 + Area 3 + Area 4) lost.

- Government: gain of government revenue due to introduction of the tariff. Government revenue is Area 3, mathematically the value can be calculated: (Q3-Q2)*tariff.

- Domestic producers: domestic producers gain surplus Area 1.

- Foreign producers: they lose revenue as tariff decreases the quantity of chicken wings imported.

- Deadweight welfare loss: due to tariff there is social surplus lost to nobody which is the DWL: Area 2 + Area 4.

* – now the extra money that is spent on those more expensive chicken wings (because of the tariff) cannot be spent on that amazing BBQ sauce. People have to eat chicken wings without BBQ sauce… That surely is loss of possible higher living standards!