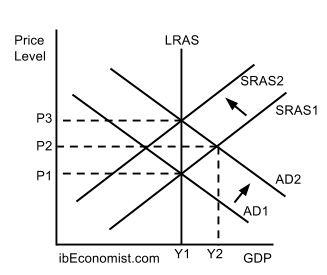

Equilibrium in the monetarist/new classical model

The diagram illustrates what takes place in an economy according to a monetarist when aggregate demand increases. Assume the economy is in equilibrium at Y1P1, where AD1 = SRAS1 = LRAS. AD shifts AD1 -> AD2. Firms respond to this increase in demand by increasing their output (GDP Y1 -> Y2). Since the economy was already at full employment level of income, the only way for firms to produce more is to make the existing factors of production work overtime (e.g. ask for workers to come work on weekends). That requires to pay them more, increasing costs of production and therefore raising the price level in the economy P1 -> P2. At P2Y2, where AD2 = SRAS1 short-run equilibrium is reached. The distance between Y2 and Y1 is the inflationary gap that opened. It occurs when the real output of an economy is above the potential output of the economy.

Monetarists believe that this situation is unsustainable and the economy will always come back to full employment level of GDP. Eventually, people will figure out that even though they are getting paid more to work overtime, the price level in an economy also rose. They understand their real wage did not increase and the so called “money illusion” fades away. That leads to short-run aggregate supply shifting SRAS1 -> SRAS2. Then a long-run equilibrium at P3Y1 where AD2 = SRAS2 = LRAS is reached.

Changes in the long-run equilibrium can only occur when LRAS shifts. Long-run aggregate supply shifts as a result of Supply-side policies implemented by the government and reasons which can be found here.

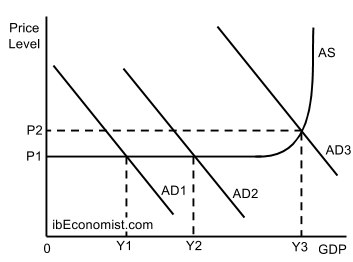

Equilibrium in the Keynesian model

In the Keynesian model equilibrium can be at any level of income, where AD = AS. In the previous (monetarist) model we saw that increases in AD result in inflationary gaps. In the Keynesian model, increases in aggregate demand need not be inflationary. AD1 -> AD2 GDP increased. However, the price level did not increase. As long as there is spare capacity in the economy (e.g. unemployed workers) according to Keynesians increases in AD will not lead to rising inflation (one does not need to offer higher wages for workers to come work). Yet, when the economy approaches its full employment level of income (“bottleneck” and the vertical part of the AS) then increases in AD will result in an inflationary gap. That will happen because there will be little to none spare capacity (e.g. workers) left. Firms then offer higher wages than their competitors to hire employees. Hence, production costs increase and the price level in an economy rises P1 -> P2.